Tim Ewington, LoopFX Board Member, shares some of his own thoughts on the big trends in Foreign Exchange..

I find it is hard to grasp the scale of daily global foreign exchange transactions.

Comprehending the $7.5 trillion traded daily is, for me, like getting to grips with the 147-million-kilometre journey to the sun. I need Elon’s help.

But I can make a comparison. Daily FX trades, according to the Bank of International Settlements, are well over 30 times the value of global equity trades.

This is a huge market, and the trends are very clear.

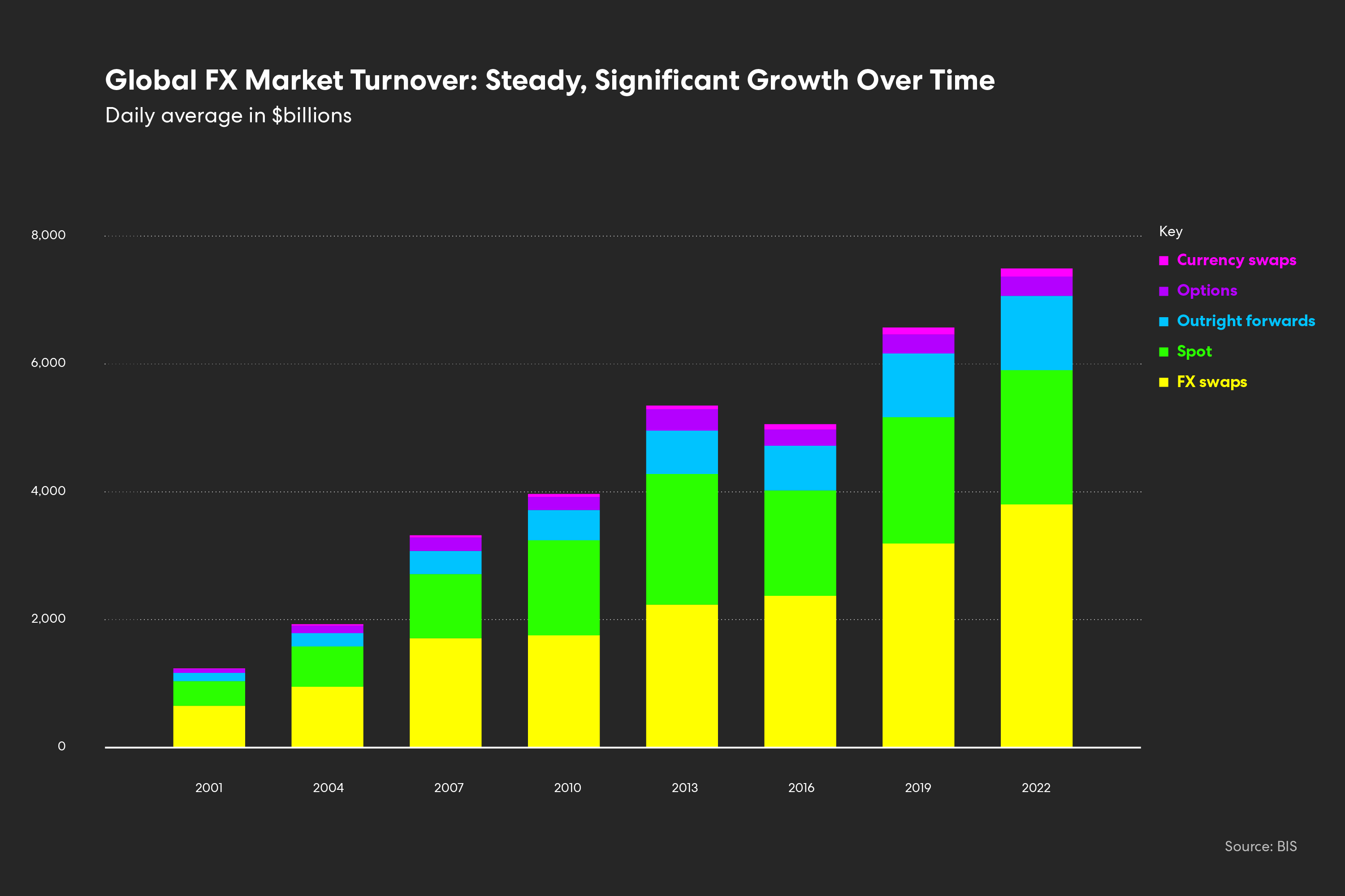

The first trend is the rapid growth in the value of transactions.

FX turnover has increased by 6 times over the last 21 years as global trade has expanded and business has globalised under the benign influence of the World Trade Organisation in a period of more relaxed international relations. Alongside the growth of trade, hedging currency risk and managing funding liquidity have become more important and new opportunities to profit have emerged by taking currency positions and betting on future currency movements.

All have driven transaction volumes and value.

One might expect the rise of global tensions, particularly between China and the West and discussion of near-shoring and the shortening of supply chains to have reduced the scale of FX transactions. But the BIS data shows foreign exchange increasing 15% over the last 3 years as you can see in the chart below.

FX remains a growth market with no sign - yet - of deglobalisation affecting the scale of foreign exchange transactions.

The two largest segments, FX Swaps and Spot transactions, have increased over 5 times in value over the last 20 years.

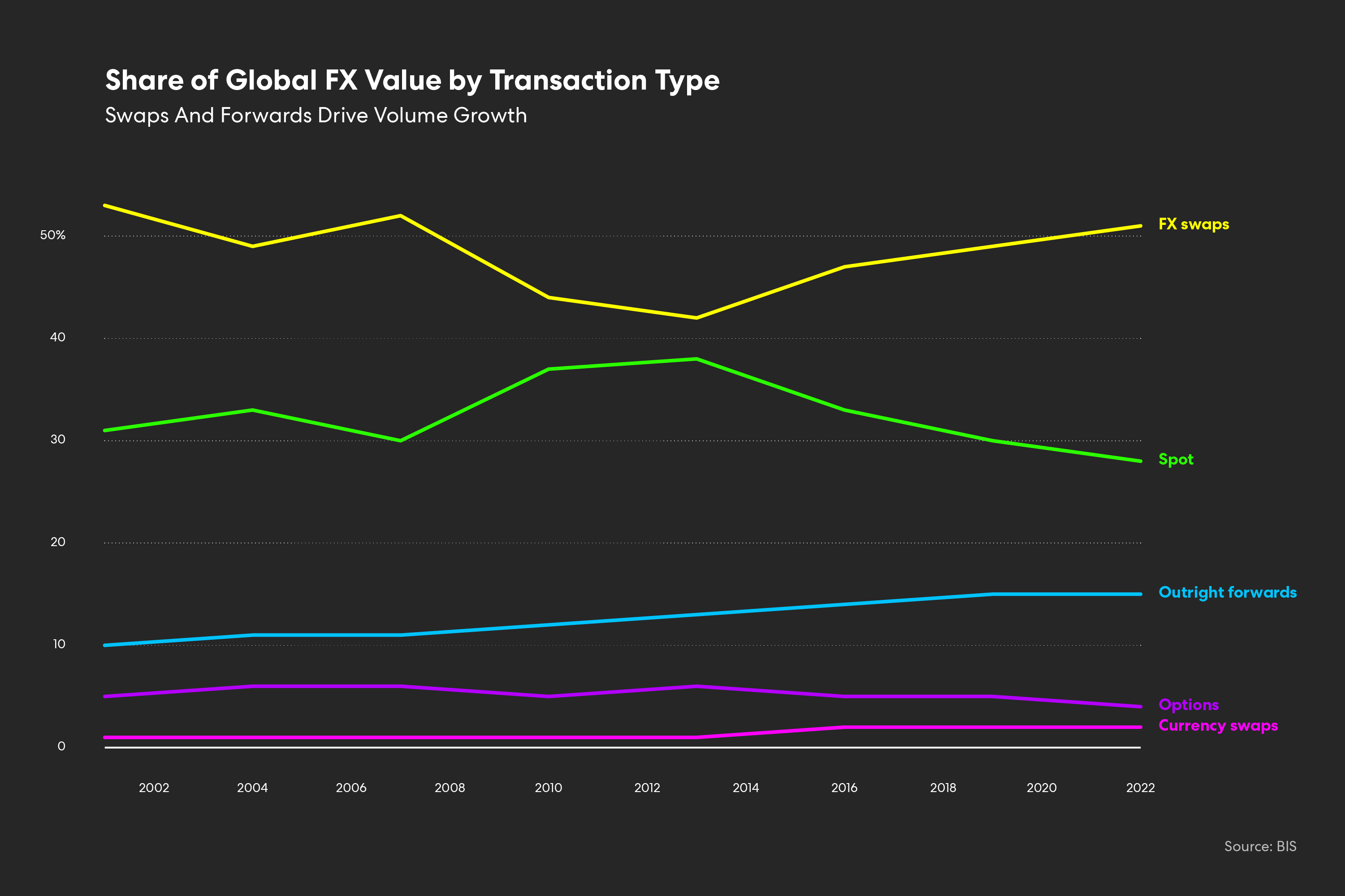

The second trend is the growing share of swaps and forwards.

Spot transactions grew their share over the first decade but have since fallen back to 28% of FX volume; FX swaps have mirrored this trend in reverse and now represent the biggest share of the market at over 50%; forwards have quietly gained over time, reaching 15%.

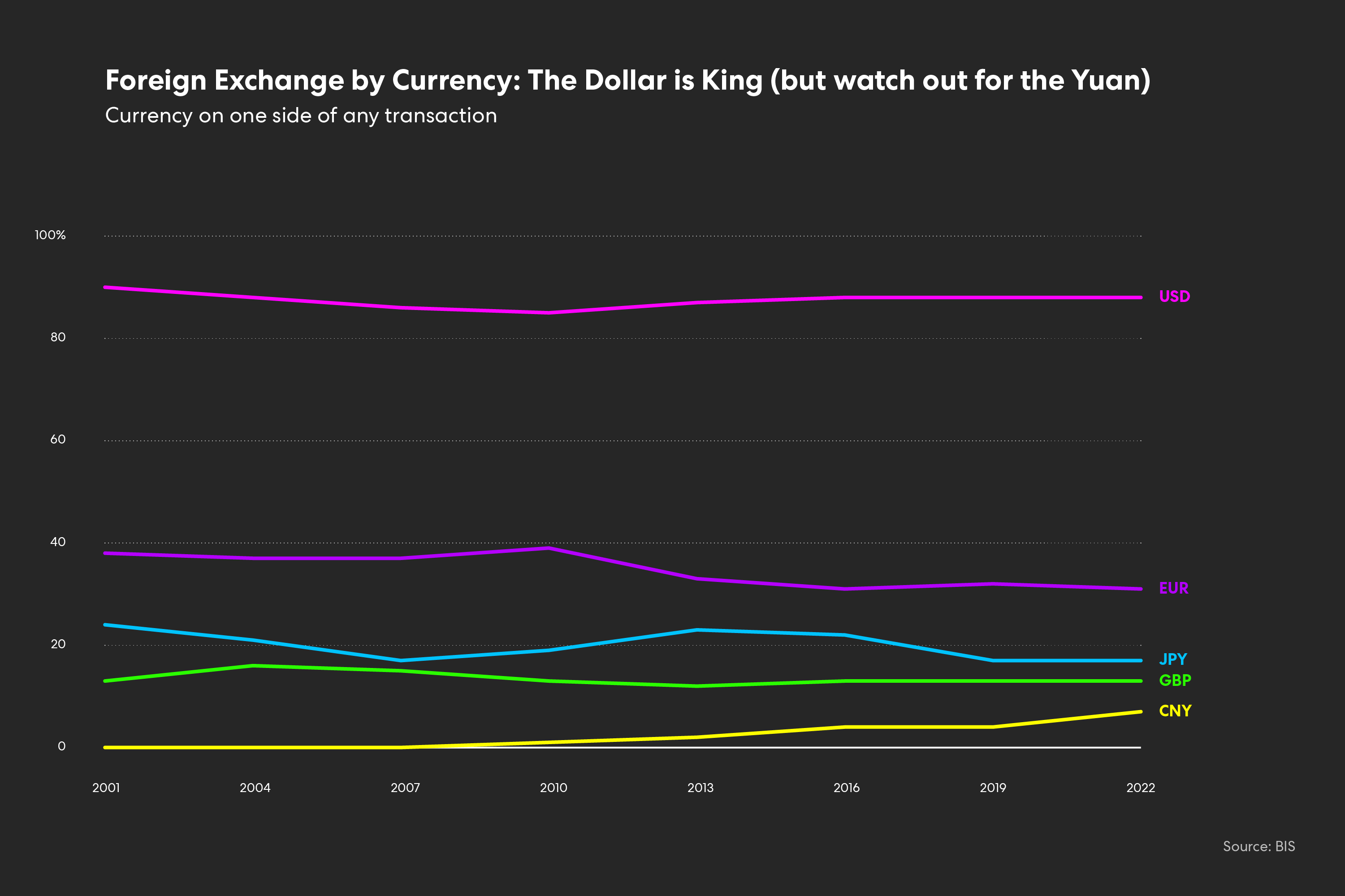

The third trend is the solidity of the dollar in FX and its role as the global reserve currency.

The dollar has firmly held its crown secure, ruling supreme across all types of foreign exchange transaction, its strength growing since Bretton Woods and the end of the Second World War.

The dollar now sits on one side of over 85% of spot, swap, and forward transactions. Its power as the currency of choice for international trade, for global payments and for the denomination of loans, combined with its intermediary role when trading less-liquid currencies guarantees pre-eminence in the short and medium term.

There has been much discussion of de-dollarisation and that the dollar might lose its “exorbitant privilege” (as former French President D’Estaing described it). Is there evidence that the Yuan is becoming a threat?

The rapid rise of China and the Yuan is visible. Twenty years ago, the Yuan could hardly be seen on the chart. It is now involved in 7% of transactions.

But the Euro remains the second largest currency on one side of 31% of trades. And both the Yen and the Pound remain ahead of the Yuan.

Despite the scale of US dollar printing and a decade of loose money, there is no evidence in the figures that the dollar is losing its special status at the moment.

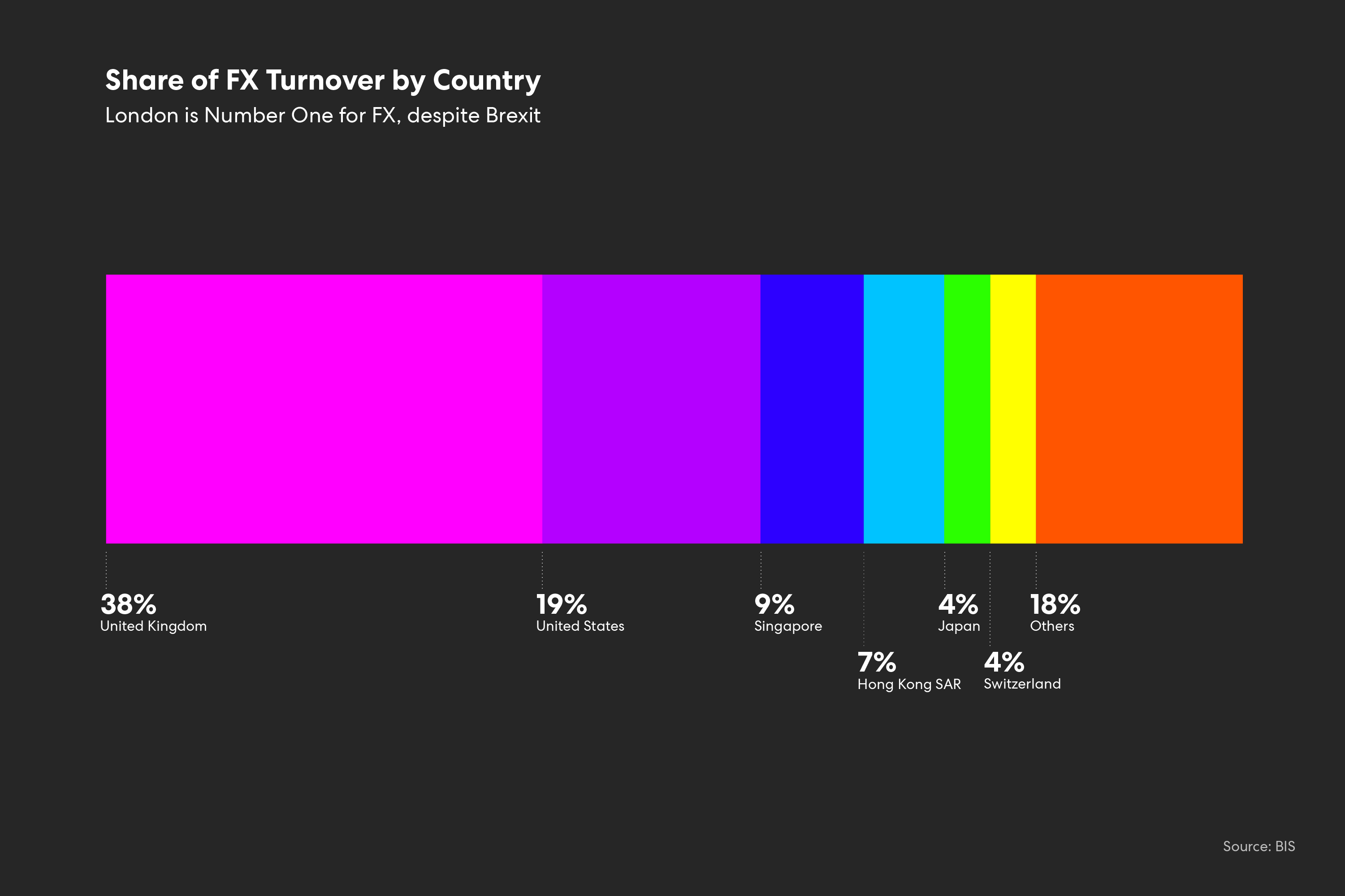

The final trend is the enduring importance of London as the dominant hub for global currency trading.

Six financial hubs – London, New York, Singapore, Hong Kong, Tokyo and Switzerland - rule the FX market with over 80% of foreign exchange trades.

London stands head and shoulders above the rest, supported by its unique place across time zones and the concentration of its FX infrastructure.

London, with its 38% share of global FX, is the hub for over twice the volume of transactions carried out in New York.

For LoopFX, London is the natural home from which to launch its new approach to facilitating large ticket FX transactions.